NPCI Link Aadhaar Card is an essential process for ensuring that your bank account receives government subsidies, direct benefit transfers, and other Aadhaar-based payments without interruption. This linkage connects your Aadhaar number with your bank account through the National Payments Corporation of India, enabling seamless and verified transactions across banking systems.

Many users remain unsure about how Aadhaar seeding works, how to check status, or why it matters for daily banking. Understanding the process clearly helps avoid payment failures, rejected benefits, and unnecessary bank visits while maintaining compliance with banking and identity regulations.

What Is the NPCI Link Aadhaar Card, and Why Does It Matter?

The NPCI Link Aadhaar Card process allows banks to map a customer’s Aadhaar number with a specific bank account in the NPCI database. This mapping identifies the default account for receiving Aadhaar-based payments such as subsidies, pensions, and welfare scheme benefits.

Once linked, the system ensures:

- Faster credit of government benefits

- Reduced chances of payment rejection

- Secure identity verification

- Centralized Aadhaar-based transaction routing

Without proper linkage, payments may fail or be redirected incorrectly, especially when multiple bank accounts exist under the same Aadhaar number.

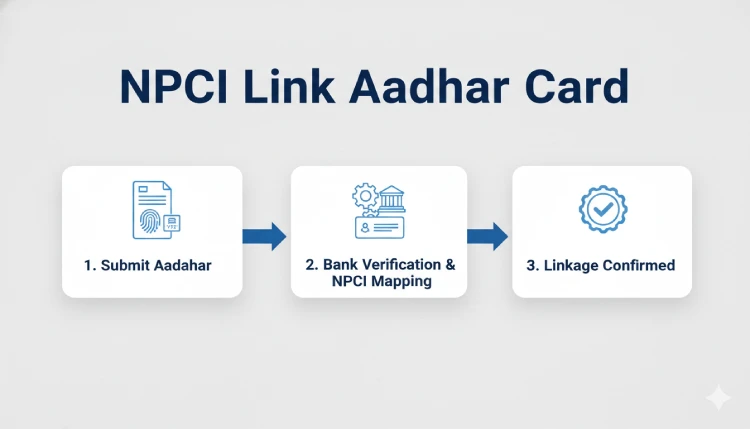

How NPCI Aadhaar Seeding Works

NPCI Aadhaar seeding is a backend process handled by banks but initiated by the account holder. After submitting Aadhaar consent, the bank verifies details and updates the NPCI mapper.

The process generally involves:

- Submitting Aadhaar details to your bank

- Bank verification with UIDAI

- Mapping Aadhaar to a selected bank account

- Confirmation of successful seeding

You can also track progress through the official NPCI link option available online, which allows users to verify whether Aadhaar mapping has been completed correctly.

Ways to NPCI Link Aadhaar Card Online

Banks offer multiple channels for linking an NPCI Aadhaar card online, depending on facilities available. Common methods include:

- Internet banking Aadhaar seeding option

- Mobile banking apps with Aadhaar linking feature

- Visiting the bank branch with Aadhaar and ID proof

- ATM-based Aadhaar registration (supported banks only)

Once initiated, the process may take a few working days for confirmation, depending on verification speed.

How to Check NPCI Aadhaar Link Status

Checking the NPCI link Aadhaar status helps ensure that Aadhaar-based payments reach the correct account. Status checks are useful if benefits are delayed or redirected.

You can usually verify status through:

- Bank’s official website or mobile app

- NPCI status portals supported by banks

- Customer support or branch inquiry

The NPCI status confirms whether Aadhaar is mapped, pending, or rejected, allowing corrective action if needed.

Common Issues During Aadhaar Seeding

Despite a simple process, users may face issues such as:

- Mismatch in name or date of birth

- Multiple bank accounts linked to Aadhaar

- Incomplete bank verification

- Outdated Aadhaar information

In such cases, resubmitting details or updating Aadhaar records before retrying NPCI Aadhaar seeding online usually resolves the issue.

Difference Between Aadhaar Linking and NPCI Mapping

Many users confuse Aadhaar-bank linking with NPCI mapping. Aadhaar linking connects your Aadhaar to a bank account for KYC, while NPCI Aadhaar Link determines which account receives government payments.

Key distinction:

- Aadhaar linking: Bank-level identity verification

- NPCI mapping: Payment routing through NPCI

Ensuring correct NPCI Aadhaar seeding prevents benefit misdirection when multiple accounts are active.

Security and Privacy Considerations

Aadhaar seeding follows strict regulatory guidelines. Banks use encrypted channels to share information with NPCI, and customer consent is mandatory. Users should only initiate linking through authorized bank platforms or verified portals to avoid fraud or data misuse.

Regularly reviewing linkage status and keeping Aadhaar details updated adds an extra layer of financial security.

Final Section

NPCI Aadhaar linkage plays a vital role in ensuring smooth digital payments and uninterrupted benefit transfers. By understanding the process, checking status regularly, and resolving errors promptly, users can maintain reliable access to Aadhaar-based financial services.

FAQ (Frequently Asked Question)

Q1. What is the NPCI Link Aadhaar Card used for?

NPCI Link Aadhaar Card ensures your Aadhaar number is mapped to a bank account for receiving government benefits and Aadhaar-based payments securely.

Q2. How long does NPCI Aadhaar seeding take?

In most cases, NPCI Aadhaar seeding is completed within 2–5 working days after successful verification by the bank.

Q3. Can I change my NPCI-linked bank account?

Yes, you can request your bank to update or modify NPCI Aadhaar seeding if you want a different account to receive Aadhaar-based payments.